Bitcoin Price Prediction 2025-2040: Analyzing the Path to $123K and Beyond

#BTC

ArrayBTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge as Price Tests Key Levels

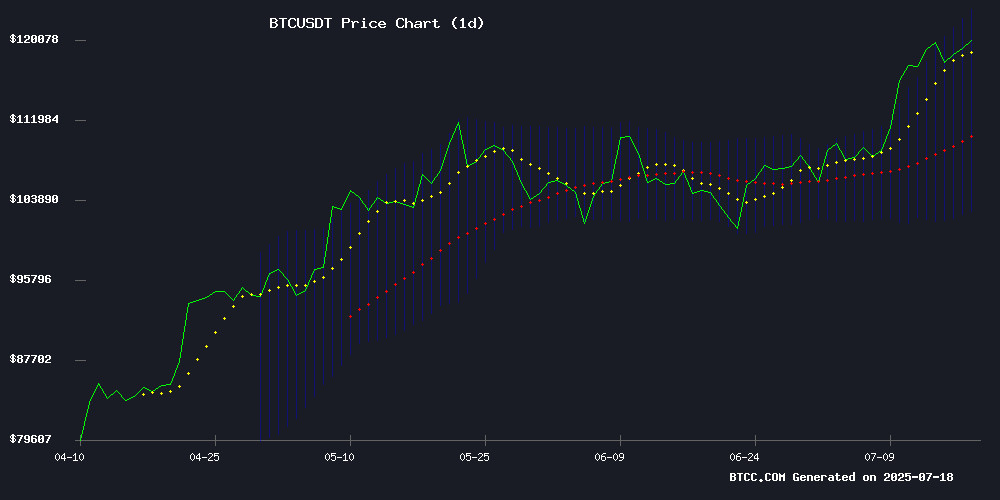

According to BTCC financial analyst William, Bitcoin (BTC) is currently trading at $120,355.41, comfortably above its 20-day moving average (MA) of $112,961.60. This positioning suggests underlying strength in the market. The MACD indicator, while still negative at -5,706.53, shows signs of convergence as the signal line (-4,353.22) narrows the gap with the MACD line. This could indicate weakening downward momentum.

Notably, the price is testing the upper Bollinger Band at $123,185.15, which often acts as a resistance level. A decisive break above this level could trigger a new bullish phase. The middle band at $112,961.60 now serves as strong support, with the lower band at $102,738.05 representing a potential buying zone should a pullback occur.

Market Sentiment Turns Bullish as Institutional Interest Grows

BTCC financial analyst William notes that current news FLOW strongly supports bullish sentiment for Bitcoin. The announcement that Matador Technologies aims to acquire 6,000 BTC (potentially controlling 1% of supply by 2027) highlights growing institutional demand. Meanwhile, the surge in new BTC holders suggests retail participation is increasing, typically a positive sign for sustained rallies.

Other supportive factors include stablecoin inflows (indicating dry powder for crypto purchases), decreased whale deposits (reducing sell pressure), and growing bitcoin DeFi activity. While regulatory developments like the potential $137B penalty for Upbit bear watching, the overall news backdrop appears favorable for continued price appreciation.

Factors Influencing BTC's Price

Matador Technologies Aims to Acquire 6,000 BTC, Targeting Top 20 Corporate Holder Status by 2027

Matador Technologies has filed a CA$900 million shelf prospectus to fuel its ambitious Bitcoin treasury strategy, targeting ownership of 6,000 BTC by 2027. The Canadian firm, which currently holds 77.4 BTC (~$9 million), seeks to control approximately 1% of Bitcoin's fixed supply—a milestone that would place it among the top 20 corporate holders globally.

The company's "flywheel" strategy combines direct BTC accumulation, synthetic mining, and DeFi-linked revenue streams. CEO Deven Soni emphasized Bitcoin's centrality to the business model: "Our business is structured around bitcoin as a core asset." Near-term targets include reaching 1,000 BTC by 2026.

This aggressive accumulation plan signals growing institutional confidence in Bitcoin's long-term value proposition. The shelf filing provides Matador with flexible capital-raising options over the next two years to execute its crypto treasury objectives.

Bitcoin Holds Above $117K Amid Whale Deposit Decline and Stablecoin Inflows

Bitcoin maintains bullish momentum, trading at $117,847 despite a 4.1% retreat from recent highs. The asset has gained nearly 10% over the past week, with on-chain data suggesting sustained buying interest.

Analyst Amr Taha notes a strategic shift in whale behavior, with Binance deposits from large holders dropping $2.25 billion over 30 days to $4.5 billion. This reduction in exchange inflows typically signals decreased selling pressure, potentially stabilizing prices in the NEAR term.

Concurrently, rising stablecoin inflows point to growing risk appetite among investors. The combination of whale accumulation and fresh capital entering via stablecoins creates a supportive environment for Bitcoin's upward trajectory.

U.S. Government's Bitcoin Holdings Spark Strategic Concerns

Senator Cynthia Lummis has raised alarms over reports indicating the U.S. government has liquidated more than 80% of its Bitcoin reserves. A Freedom of Information Act response revealed the U.S. Marshals Service currently holds just 28,988 BTC—a sharp decline from the estimated 198,012 BTC previously under federal control. The discrepancy has fueled speculation about a large-scale sell-off, though on-chain data suggests the bulk of the holdings remain in seized status across various law enforcement agencies.

The controversy highlights the opaque nature of government crypto custody. While the USMS oversees forfeited assets for auction, other agencies retain Bitcoin pending judicial review. Arkham Intelligence estimates the U.S. still controls nearly $23.5 billion in Bitcoin across multiple wallets. "This is a total strategic blunder," Lummis declared, warning the MOVE could disadvantage the U.S. in the global race for crypto dominance.

Whales? No, Newbies: Surge In New BTC Holders Fuels Market Rally—Study

Bitcoin's recent rally past $123,000 is being driven by an influx of new investors, not just institutional whales. On-chain data from Glassnode reveals first-time buyers accumulated 140,000 BTC over two weeks, boosting their holdings from 4.77 million to nearly 5 million BTC—a 2.86% surge. This fresh capital has provided critical support for the latest price breakout.

Short-term holders are also demonstrating conviction, with their cost basis crossing $100,000 for the first time. These investors have held through volatility rather than selling at a loss, signaling expectations of further upside. Glassnode's heatmaps show dip buyers remain active, creating a dynamic support floor under the market.

Bitcoin Price Eyes $123K Explosion—Traders Brace for Breakout

Bitcoin is staging a fresh rally, with its price consolidating above $119,000 after rebounding from a dip to $115,730. The cryptocurrency broke through a key bearish trend line at $119,000 on the hourly chart, signaling bullish momentum. Traders are now eyeing resistance levels at $120,500 and $121,400, with a potential push toward $123,150 if buying pressure sustains.

The recovery follows a brief correction from the recent high of $123,200, with the 100-hour Simple Moving Average acting as support. Market sentiment remains optimistic as Bitcoin tests higher price thresholds, fueled by institutional interest and broader crypto market gains.

Canadian Bitcoin Firm Matador Technologies Aims to Control 1% of BTC Supply by 2027

Matador Technologies, a Toronto-based Bitcoin company, has unveiled ambitious plans to accumulate 1% of Bitcoin's total supply by 2027. The firm currently holds 77.4 BTC but aims to scale its holdings to 1,000 BTC by the end of 2026 and potentially 6,000 BTC by 2027. This WOULD position Matador among the top 20 public companies globally in terms of Bitcoin holdings.

The company has filed a CAD $900 million shelf prospectus to support its acquisition strategy, which includes a mix of equity offerings, convertible financings, and asset sales. Matador may also explore Bitcoin-backed credit lines and strategic acquisitions to achieve its goal.

"Our long-term Bitcoin treasury strategy is clear: we want to be a significant player in the ecosystem," the company stated in a recent announcement. The move reflects growing institutional confidence in Bitcoin as a store of value, particularly among Canadian firms.

Trump Officials Hold $193M in Crypto as Upbit Faces $137B Penalty

Senior TRUMP administration officials collectively hold over $193 million in cryptocurrency assets, according to Washington Post disclosures. President Trump's personal crypto holdings exceed $51 million, while Vice President Vance maintains Bitcoin reserves valued up to $500,000. The revelation contrasts sharply with Biden administration officials, who reported zero digital asset holdings.

South Korea's Upbit exchange faces potential penalties totaling $137 billion for 9.57 million regulatory violations. The platform's compliance failures emerge as global regulators intensify scrutiny of crypto markets.

House-approved cryptocurrency legislation has driven record highs for related stocks, with digital asset values doubling across markets. The Trump administration's substantial crypto holdings signal unprecedented governmental acceptance of blockchain-based assets.

Bitcoin Pioneer Adam Back Launches $3.5B Treasury Firm With Cantor Fitzgerald

Bitcoin advocate and Hashcash inventor Adam Back is partnering with Cantor Fitzgerald to establish the Bitcoin Standard Treasury Company (BSTR), a crypto treasury firm set to go public via a SPAC merger with Cantor Equity Partners I (CEPO). The deal, spearheaded by CEPO's Brandon Lutnick, positions BSTR as a significant institutional player in the cryptocurrency space.

Back will assume the role of CEO, while former pension fund strategist Sean Bill joins as CIO. The firm is poised to debut with over 30,000 BTC—valued at more than $3.5 billion—making it the fourth-largest publicly traded holder of bitcoin, trailing only MicroStrategy, MARA Holdings, and Tesla. Founding shareholders will contribute 25,000 BTC, with an additional 5,021 BTC from early investors.

BSTR also aims to raise up to $1.5 billion through a PIPE deal, including $400 million in equity, $750 million in convertible notes, and $350 million in preferred stock. CEPO may contribute up to $200 million, contingent on redemption levels. At current prices, the PIPE proceeds could add another 12,500 BTC to BSTR's holdings, potentially elevating it to the third spot among corporate holders.

The launch underscores a growing trend among Wall Street firms emulating MicroStrategy's bitcoin treasury model. As crypto adoption accelerates, BSTR seeks to become a cornerstone institutional vehicle for bitcoin exposure.

Corporate Bitcoin Holdings: A Double-Edged Sword for Crypto Markets

Bitcoin treasury companies are walking a tightrope between institutional adoption and systemic risk. Public firms now hold over 4% of BTC's total supply—double 2024 levels—with MicroStrategy's 580,000 BTC position dominating 53% of corporate holdings. This concentration creates potential fault lines.

Divergent strategies emerge: pure-play accumulators like MicroStrategy face existential risk during prolonged bear markets, while hybrid adopters like GameStop buffer volatility by balancing Core operations with BTC exposure. The market hasn't forgotten how cascading liquidations in 2022 turned corporate hodling into a contagion vector.

Institutional accumulation mirrors gold's financialization—but with higher stakes. When public companies treat BTC as a treasury asset rather than a transactional medium, they import traditional finance's boom-bust cycles into crypto's fragile liquidity pools.

Trump Administration Explores Tax Exemption for Small Bitcoin Transactions

The WHITE House is considering a de minimis tax exemption for Bitcoin transactions under $600, a move aimed at facilitating everyday crypto use. Press Secretary Karoline Leavitt confirmed the administration's support, signaling potential regulatory easing for small-scale crypto payments.

Senator Cynthia Lummis has proposed more aggressive reforms, advocating for a $300 threshold and revised taxation of mined assets. The policy shift could accelerate retail adoption by eliminating capital gains reporting for minor transactions.

Bitcoin DeFi Protocols Experience Surge Amid BTC Price Rally

Bitcoin decentralized finance (DeFi) protocols are witnessing exponential growth as Bitcoin's price continues to soar. Data from DefiLlama reveals that the total value locked (TVL) in Bitcoin-based DeFi surged from $304.66 million in January 2024 to over $7.117 billion, driven by institutional inflows, new protocol launches, and innovative financial products like Bitcoin-backed loans and liquid restaking.

The institutional adoption of Bitcoin DeFi—dubbed BTCFi—is accelerating, with platforms like Stacks reporting rapid bridging of sBTC, a Bitcoin-backed asset enabling DeFi transactions. Rena Shah, COO of Trust Machines, notes that institutions are recognizing Bitcoin's potential as collateral, fueling demand for BTCFi strategies. "When everyday users see BTC hit new all-time highs, it creates an opportunity for a second step—Bitcoin DeFi," Shah remarked.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market fundamentals, BTCC financial analyst William provides these long-term projections for Bitcoin:

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $123,000-$150,000 | ETF inflows, halving effects, institutional adoption |

| 2030 | $250,000-$400,000 | Mainstream adoption as collateral, store-of-value status |

| 2035 | $600,000-$1,000,000 | Network effects, possible scarcity premium |

| 2040 | $1,500,000+ | Full monetization, potential global reserve asset status |

These projections assume continued network growth, no catastrophic regulatory changes, and Bitcoin maintaining its dominance in the crypto ecosystem. Near-term, the $123K resistance remains the key level to watch for confirmation of upward momentum.